Calculate now and get free quotation. Unsold Property Enquiry System Malaysia UPESM Mobile.

Take this as an example.

. How can I make an appeal on the stamp duty if I am not happy with the valuation that had been carried out. Stamp Duty Loan Calculation Formula. Loan Sum x 05.

As with the process for Stamp Duty any. The transferee is responsible for the payment of stamp duty. Pada kali ini buat.

Stamp Duty Loan Calculation Formula Loan Sum x 05 Note. Sewa tahunan RM2400 ke bawah. Enquiry on Housing Loan Status.

Enquiry on Stamp Duty Status. Change of Terms Case Status. Stamp duties are imposed on instruments and not transactions.

The rate of duty varies according to the nature. JPPH provide consultancy service related to valuation and property services. Further to this there is a right of appeal to the High Court.

Sebagai contoh RM1200 sewa bulanan dalam masa setahun perjanjian. Enquiry on Conversion of Land Use Status. A valuation report will be prepared by JPPH Malaysia to Inland Revenue Board to imposed the Ad-Valorem Stamp Duty base on the stamp duty rate as stated above.

Enquiry on Stamp Duty Status. The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan. Stamp Duty for Loan.

Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement. While the Stamp Dutys concept is used to sell and transfer any property it also applies on any loan of agreements a flat 05 rate applied on the full loan value. The date of the assessment is the date of death.

As with stamp duty any query on the valuation must be addressed directly to the Estate Duty Office with a copy to JPPH. The Stamp Duty Office SDO of the Inland Revenue Board IRB refers the prescribed form to JPPH where the market value of the property is ascertained and reported within one 1 working day for standard SDO then informs the transferee lawyer of the duty payable. The IRB will impose Stamp Duties based on the valuation reported by JPPH.

Please note that the above formula merely provides estimated stamp duty. Tiada setem duti dikenakan. The actual stamp duty will be rounded up according to.

Stamp Duty Loan Calculation Formula. House Price Inquiry for Government. House Price Inquiry for Government.

A full stamp duty ad valorem will be imposed on the purchasers in this matter. Please note that the above formula merely provides. The workings of the stamp duty are tax based on specific tiers with its own percentage for each level.

SPA Price or JPPH Valuation whichever higher. Estate Duty is imposed on property held by a person. Online Services Enquiry on Housing Loan Status.

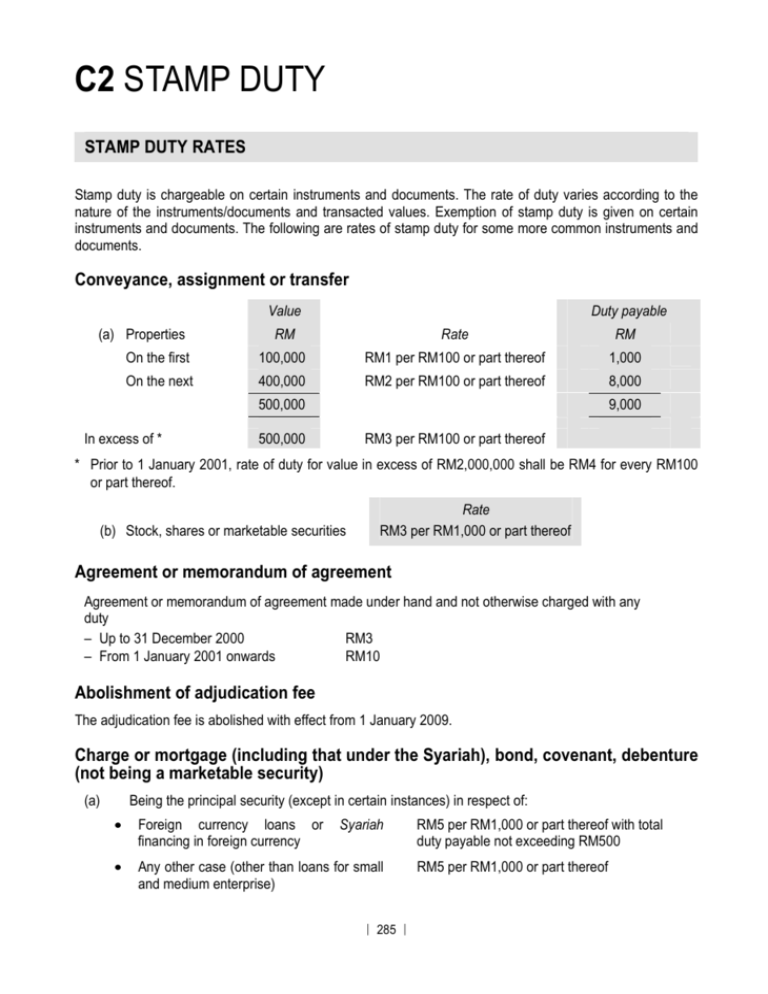

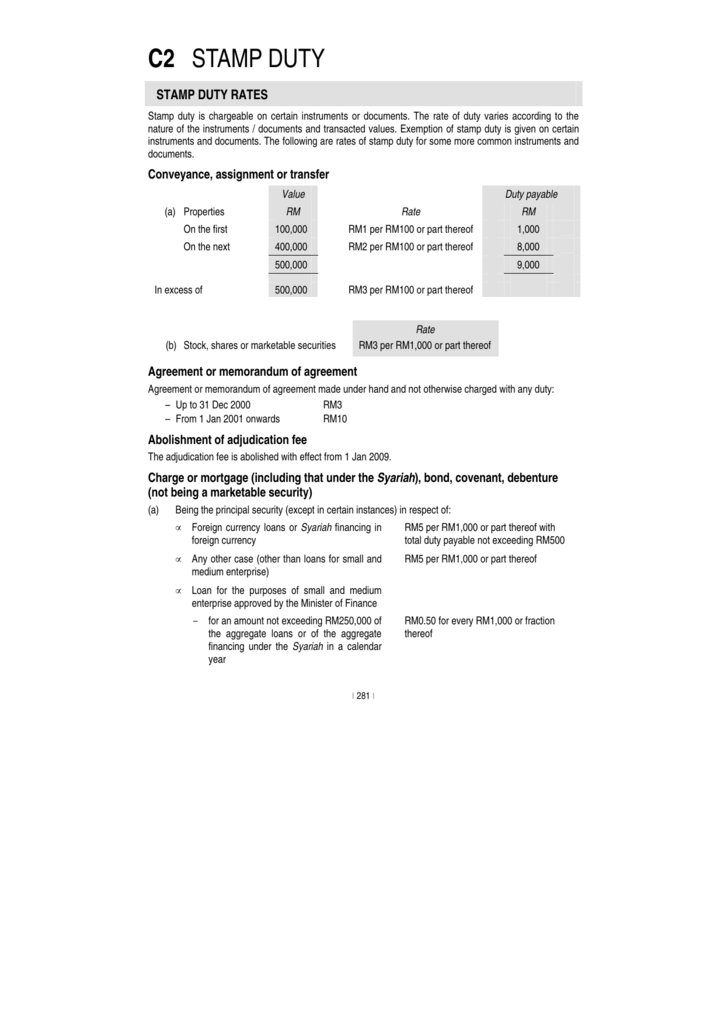

The rate of stamp duty effective from 01012019 payable for transfer of properties in Malaysia is calculated as follows. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. C2 STAMP DUTY Stamp duty is chargeable on certain instruments or documents.

Stamp Duty Case Status. Dato Sr Azmi bin Abdul Latif Ketua Pengarah Penilaian dan Perkhidmatan Harta serta Sr Aina Edayu binti Ahmad Pengarah Pusat Maklumat Harta Tanah Negara NAPIC. 1 on the first RM100000 of the property price.

Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. On 2752021 the Johor High Court allowed the taxpayers appeal against the Notice of Stamp Duty Assessment Assessment issued by the Stamp Duty Collector. House Price for Goverment.

NAPIC provide accurate comprehensive and timely information relating to the. An instrument is defined as any written document and in general stamp duty is levied on legal commercial and financial instruments. Enquiry on Conversion of Land Use Status.

In love affection with the mother still alive during the transfer there is a 50 stamp duty on the. If based on the subsequent JPPH valuation the proper. The party responsible for this administration assessment and tax is the Estate Duty Collector while JPPH is responsible for assessing the property involved.

Understanding Stamp Duty In 2021 Top 5 Questions Answered

Research Methodology Process Download Scientific Diagram

Background Valuation And Property Management Department Portal

Chapter 3 Stamp Duty Pdf Chapter 3 Stamp Duty Rem 251 Introduction Stamp Duty Is A Duty Created And Governed By Statute Stamp Act 1949 Act 378 Course Hero

Understanding Stamp Duty In 2021 Top 5 Questions Answered

Property Registration Procedure In Malaysia Download Scientific Diagram

C2 Stamp Duty The Malaysian Institute Of Certified Public

C2 Stamp Duty Malaysian Institute Of Accountants

Journal Of Valuation And Property Services

Stamp Duty Valuation And Property Management Department Portal

Understanding Stamp Duty In 2021 Top 5 Questions Answered

Understanding Stamp Duty In 2021 Top 5 Questions Answered

Valuation And Property Management Department Portal Excellent Service Our Commitment